DATs have accumulated over $7b ETH. There are only a few large ETH vaults that could provide income for DATs at this scale onchain:

There are two primary sources of yield for ETH here: the native staking rate (including MEV rewards) and EIGEN emissions.

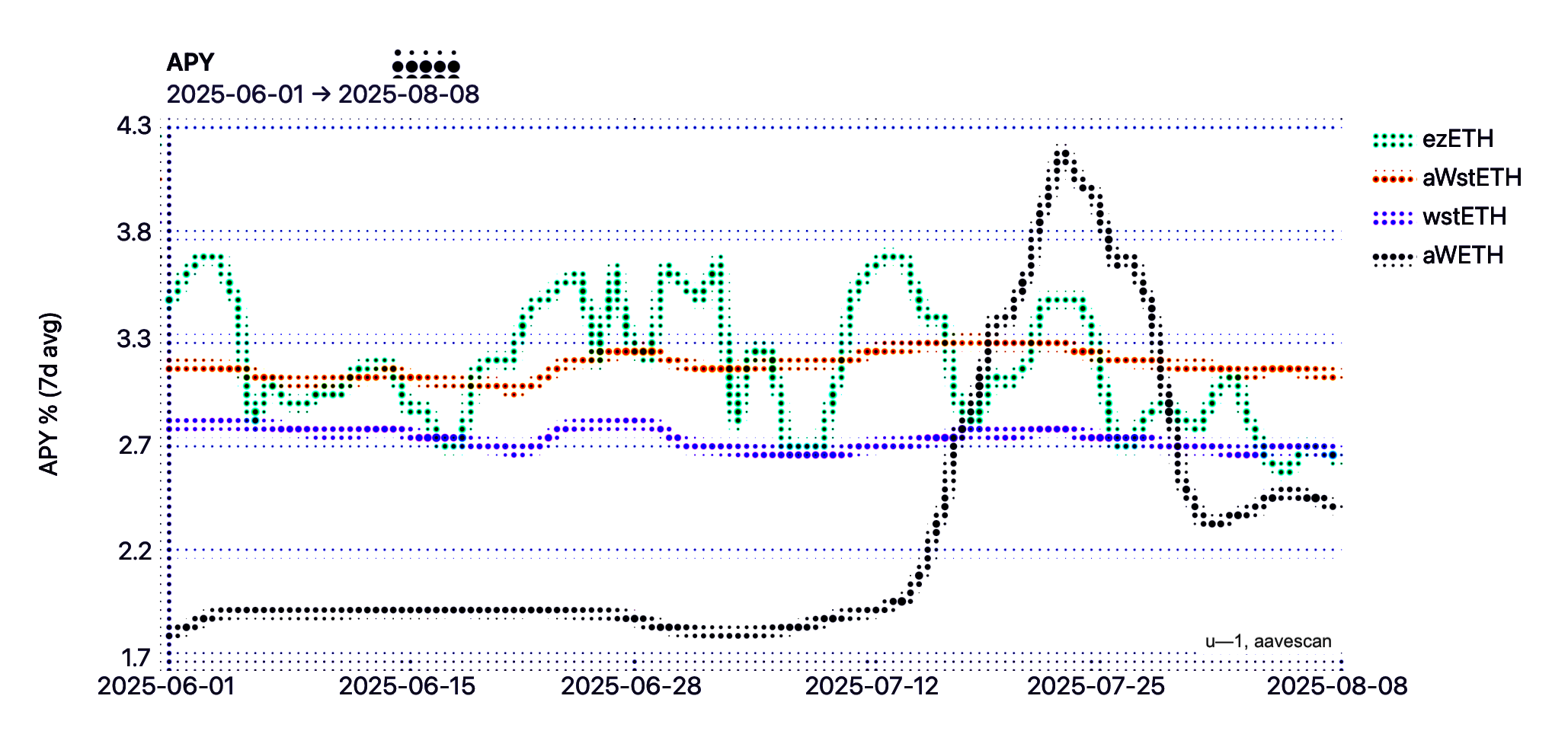

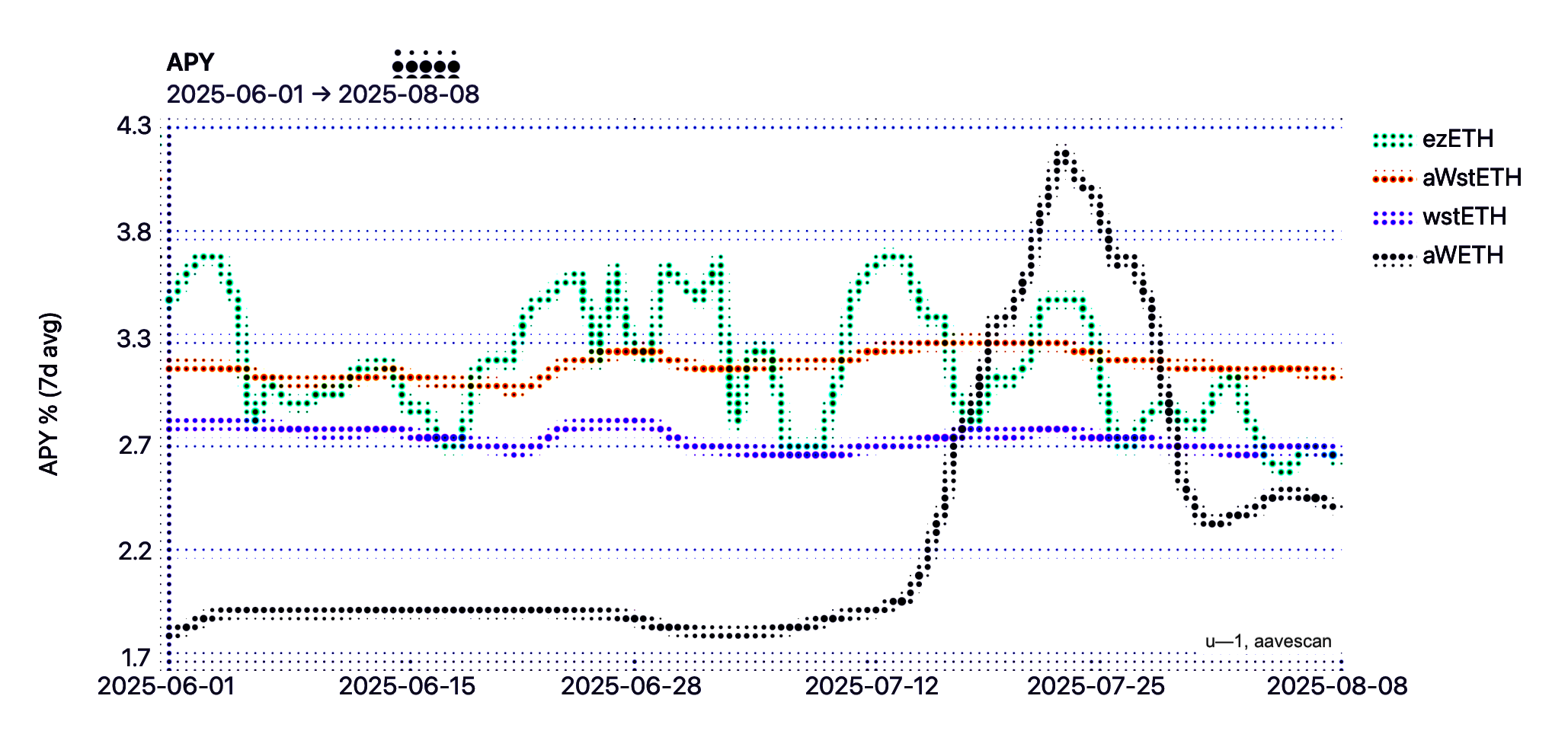

The most obvious choice for DATs is to stake ETH using an institutional staking service and earn 2.7% APY.

Beyond the native staking rate, a DAT could earn 3% APY on EigenLayer by collecting EIGEN emissions on top of the native Ethereum staking rate (the combined yield is strictly greater). Other options, such as supplying ETH on Aave, would produce returns less than 2%.

Theoretically, DATs could increase their income in the ETH ecosystem by taking advantage of their mainstream publicity. For example, a DAT could accumulate AAVE while allocating ETH deposits into Aave markets and benefit from an uplift in attention for the protocol token.

A more subtle strategy would be to farm EIGEN emissions while bringing attention to EigenLayer. An increasing token price would mean higher yields for EigenLayer depositors and, in effect, a DAT could skew the income on their ETH holdings without buying another coin.

Earning +0.3% APY may not outweigh the risks of tying your DAT to a particular brand. There are multiple DATs in competition though and yield could be a differentiator.